Coinbase is one of the largest crypto exchanges in the world and the largest one in the US. The San Francisco-based company also operates a crypto trading platform called GDAX, which is among the largest in the US. Coinbase offers both exchange and wallet solutions, but we will focus on the exchange functions at this time.

At the moment of writing, Coinbase boasts with 12.4 million happy customers and around $40 billion exchanged since its foundation in 2012. Interestingly, when Bitcoin price was rallying beyond $7500 before the SegWit2x fork was canceled, Coinbase added at least 100,000 new customers in a single day, which was a record growth for the company.

At the moment of writing, Coinbase boasts with 12.4 million happy customers and around $40 billion exchanged since its foundation in 2012. Interestingly, when Bitcoin price was rallying beyond $7500 before the SegWit2x fork was canceled, Coinbase added at least 100,000 new customers in a single day, which was a record growth for the company.

Cryptocoins Available for Trade on Coinbase

Contents

Coinbase operates with three cryptocurrencies: Bitcoin (BTC), Ethereum (ETH), and Litecoin (LTC). Unfortunately, users cannot trade other coins besides the mentioned ones – not even the after-fork coins such as Bitcoin Cash or Ethereum Classic.

The exchange service planned to offer trading conditions for Bitcoin2x (B2X), a cryptocoin that was expected to appear after the SegWit2x hard fork. However, as the SegWit2x fork was canceled, Coinbase remains with the three popular coins.

As for the fiat currencies, the crypto broker operates with USD, EUR, and GBP.

How Does Coinbase Work?

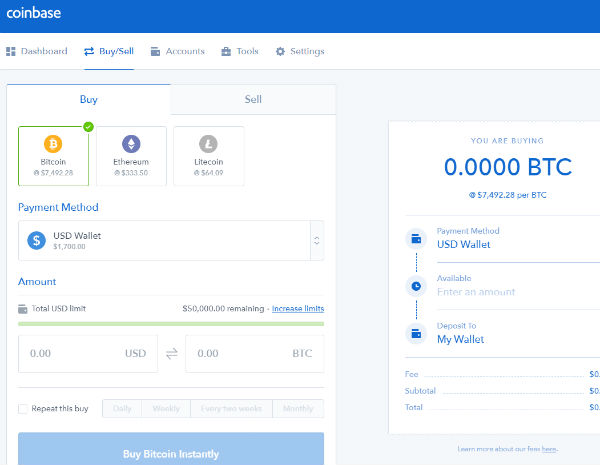

Coinbase offers an intuitive platform where users can deposit fiat money and buy cryptocurrencies. You can also trade one coin for another one, like deposit Bitcoin and buy ETH or LTC.

Coinbase is available in 32 countries, including the US, Canada, Australia, Singapore, the UK, and most of the EU countries. The deposit and withdrawal methods differ a bit based on the region, but generally, it is about wire transfer and credit/debit card.

It’s worth mentioning that you can’t buy Bitcoin or altcoins anonymously since every user has to pass through at least one of the four verification levels.

The short Coinbase trading guide would look like this:

- Register with Coinbase and verify your email address;

- Choose from Individual or Business account type;

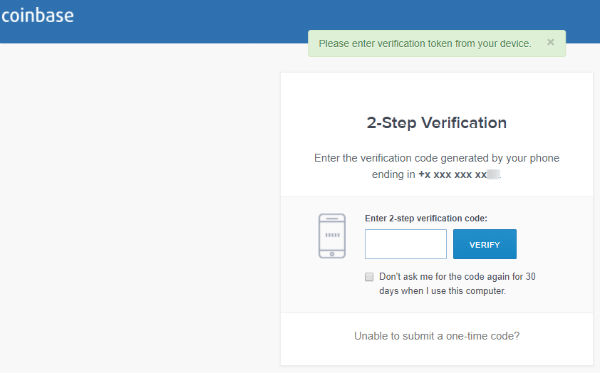

- Verify your phone number;

- Choose a payment method and pass through the verification steps related to it;

- Buy and Sell cryptocurrencies directly on the Coinbase website.

You can get $10 in FREE Bitcoin when you join Coinbase through this link –> Click Here <–

Coinbase Security and Privacy

We know that you would not entrust your funds to a random crypto exchange, so you’re probably curious to know whether Coinbase is really safe for crypto operations. The short answer is yes – the service is officially registered with the Financial Crimes Enforcement Network (FinCEN) as a Money Services Business and is compliant with the Bank Secrecy Act, USA Patriot Act, and with the US money transmission regulations.

Still, you may find a significant number of complaints on the Internet. Some of them may come from frustrated traders who recorded losses due to sharp drops in cryptocurrency prices, while other negative comments may relate to bugs, frozen accounts or company’s close relationships with the banking establishment.

In general, you would not encounter any issues when dealing with Coinbase – it has a great reputation.

The company was funded by prominent investors, such as venture capital firms Andreessen Horowitz, Digital Currency Group, Union Square Ventures (USV), and Ribbit Capital.

Besides, Coinbase has partnered with major companies to support cryptocurrency payments, including Dell, Overstock, Expedia, and Time Inc.

The exchange offers two-factor authentication (2FA) feature, which you can enable when signing in.

When it comes to privacy, we mentioned that you cannot make anonymous trades with Coinbase. The service won’t reveal your personal data to any third party, but it will know who you are and it can even track your activity and block your account under certain circumstances.

In order to get approved by the US regulators, the crypto broker had to comply with the Anti-Money Laundering (AML) and Know Your Customer (KYC) practices. It means that you will have to present your personal data, such as name and address among others.

Moreover, you can expect your Coinbase account to be shut down if you had taken part in activities like:

- Spending Bitcoin for adult services and sites;

- Bitcoin gambling;

- Trade in deep web (darknet) markets;

- Send cryptocurrencies to other crypto exchanges (like sending Bitcoin from Coinbase to Localbitcoins account).

It may sound constraining when you discover this, but if you don’t deal with the mentioned activities, you’ll have no problems with it. Millions of customers safely use Coinbase without any issue.

The great thing about this exchange is that its crypto-funds are insured, which means that if Coinbase were to be hacked or suffered a crisis, it would still pay out the funds to customers.

Coinbase Verification Procedures

Coinbase has more verification levels where each level offers higher account limits and additional features. For instance, if you stick to Level 1, you will be able to buy up to $5,000 worth of Bitcoin and sell up to $25,000 each day. The daily limit for the Level 4 is $50 thousand. However, level four users have to pass through additional verification procedures, such as sharing the ID, taxpayer ID number, and answering a few questions among others.

Coinbase has more verification levels where each level offers higher account limits and additional features. For instance, if you stick to Level 1, you will be able to buy up to $5,000 worth of Bitcoin and sell up to $25,000 each day. The daily limit for the Level 4 is $50 thousand. However, level four users have to pass through additional verification procedures, such as sharing the ID, taxpayer ID number, and answering a few questions among others.

Coinbase claims that the account limits depend on a number of factors, such as:

- Account age;

- Buying volume and activity;

- Account verification, which can refer to ID verification and bank account verification or debit/credit card verification.

The great thing about the exchange is that you can automate cryptocurrency buying weekly or monthly.

Coinbase Payment Methods and Fees

Coinbase offers several deposit/withdrawal methods. The US citizens can deposit and withdraw funds via bank wire transfers, credit/debit cards (VISA and MasterCard), and by linking their Coinbase account with one of the US bank accounts. PayPal is available for withdrawals only. Cashing out with PayPal requires a 3.75% fee.

Coinbase offers several deposit/withdrawal methods. The US citizens can deposit and withdraw funds via bank wire transfers, credit/debit cards (VISA and MasterCard), and by linking their Coinbase account with one of the US bank accounts. PayPal is available for withdrawals only. Cashing out with PayPal requires a 3.75% fee.

Besides PayPal, the same payment methods are available for the rest of the 32 countries, except Australia and Canada, where the credit/debit card is the only payment method.

There is a standard fee of 3.99% for credit/debit card transactions.

For standard bank wire transfers, the deposit/withdrawal fee is 1.49%.

There are no fees if you deposit or withdraw funds in BTC.

The Pros and Cons of Coinbase

Pros:

A wide range of payment methods, including PayPal for US users who want to withdraw;

A wide range of payment methods, including PayPal for US users who want to withdraw;- Generous buying and selling limits;

- Intuitive interface which can be accessed from almost any devices with Internet connection;

- Transfers between Coinbase users are easy and super fast;

- Both crypto and fiat deposits with Coinbase are insured;

- Users can deposit more fiat currencies, such as USD, EUR, and GBP;

- Two-factor authentication feature is available;

- Coinbase is an official crypto exchange that is complaints with the US regulations. It is a reputable brand-name that has operated for years.

Cons:

- Only three cryptocoins are available for trade: BTC, ETH, and LTC;

- The accounts are tracked, so users can find their accounts frozen if they don’t comply with the rules;

- Some users may be frustrated about the verification procedures, but they are mandatory for any regulated crypto exchange;

- Coinbase is available in 32 countries only.

Short Comparison to Other Exchanges

In terms of trading volume, Coinbase competes with Kraken, CEX.IO, and Bitstamp among others. Here are some “face-to-face” comparisons:

Kraken vs. Coinbase

- If Coinbase is among the largest crypto exchanges regarding USD volume, then Kraken is the leading exchange when it comes to EUR volume trading;

- Unlike Coinbase, Kraken offers margin trading solutions with up to 5:1 leverage, which suggests you can trade BTC or other coins by borrowing up to 80% of the funds from the crypto broker.

- Kraken has a much wider range of cryptocoins. Their list includes Bitcoin, Ethereum, Bitcoin Cash, Ethereum Classic, Ripple, Litecoin, Dogecoin, Monero, Gnosis, Zcash, Dash, Stellar, and Iconomi. Quite impressive – right?

- Recently, Kraken website has often been down.

- The wire transfer is the only payment method with Kraken.

CEX.IO vs. Coinbase

- IO offers margin trading option, with up to 3:1 leverage;

- The list of accepted fiat currencies is longer with CEX.IO. We can mention USD, EUR, GBP, and RUB among others.

- IO trading and payment fees are much higher when compared to Coinbase.

Bitstamp vs. Coinbase

- Besides wire transfers and credit/debit card, Bitstamp allows payments with AstroPay. However, Coinbase allows withdrawals with PayPal;

- Unlike Coinbase, Bitstamp is available worldwide;

- Besides BTC, ETH, and LTC, Bitstamp allows Ripple trading. The cryptocoins can be traded in pairs with USD, EUR or BTC (in the case of altcoins).

The Final Note

Our final verdict in relation to Coinbase is quite positive, as the crypto exchange is fast, safe enough, insured, and user-friendly. It has been active on the market for years.

We would recommend you to move your crypto funds to a more secure wallet, preferably a hardware wallet like Ledger Nano S or Trezor. Keeping your cryptocurrency with an online exchange is not the best decision in terms of security, and it is not only about Coinbase.

>> Click Here To Start With Coinbase And Get $10 of FREE Bitcoin Now <<

To get more tips on which cryptocurrencies to trade, check out our this free Crypto training here.

Our Rating: [yasr_overall_rating]