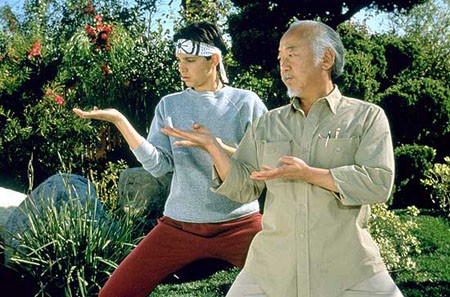

So you want to become a better Forex trader? Then you need the discipline of the Karate Kid to be a great Forex trader. Want some good tips? First you must remove your emotions from the game and follow your plan.

Here are 4 great tips from Forexcrunch.com:

- Keep a journal: Many traders acknowledge the importance of logging their trades, but they don’t really practice what they preach. The value isn’t only for offline

analyzing of your actions, but for making the right decisions. So, update your journal in real time, and write what you intend to do before making the move. Having to express your intentions to the journal will help you digest your move and verify if you’re about to do the right thing or not. Here’s a good example of a journal you can use right away.

analyzing of your actions, but for making the right decisions. So, update your journal in real time, and write what you intend to do before making the move. Having to express your intentions to the journal will help you digest your move and verify if you’re about to do the right thing or not. Here’s a good example of a journal you can use right away. - Think again: Do you feel like you’ve reached the right decision about opening a trade, closing one, or any other action? Great. But don’t act just yet. Trying thinking about it once again to make sure you are not acting out of an impulse or a gut feeling that might be wrong. Gut feelings are not necessarily bad, but they need to be verified.

- Count to 10: Another way to separate an emotional impulse from action is to count from1 to 10. Slowly. This will enable you to calm down either from a euphoric feeling or rather a desperate action.

- Stick to your plan: I guess you’ve heard that before, but this cliché is certainly useful. It is too easy to make a real time decision to ditch your plan “just this time” because there is a “one time extra-ordinary” opportunity that is beyond the scope of your plan. Bending and breaking your own rules is a slippery slope. So, check if your actions correspond to your plan before making the move, no matter how promising it looks.

That is a good start to taking you emotions out of the game. It is definitely hard when money is on the line. I find more tips on controlling your trading emotions here from etoro.com:

Controlling Emotions

Controlling emotions is an important aspect of forex discipline. The moment a position is negative, it is not uncommon to see traders exhibit any one of the following  emotions:

emotions:

- Fear

- Anxiety

- Confusion

- Panic

These emotions (especially that of fear and panic), ultimately will force the trader to try to liquidate losing positions as a measure of preserving capital. The compulsion is so strong that they may find themselves unable to trade with confidence in future, even when conditions are favorable for profits. It is not unusual to see traders hit by this bug to cut profits prematurely. Another negative emotion that can be just as bad is greed. This usually surfaces when positions are in the green. It comes up in two ways. One way is unduly hanging on to winning positions in an effort to grind out every last pip possible. The second occurs when a trader closes a position in profit, and risks a re-entry when he sees the currency pair continue its advance in an effort to maximize the position. Snag is that unlike the previous entry, this one is in uncharted waters where anything could happen. Aretracement will end up eating off some of the profits previously gained.

Imbibing Habits that Instill Discipline

There are a few habits that can make it easier to achieve trading discipline. Some of them are as follows:

1) Setting targets. It usually works well to set a realistic pip target for the day or week or month and stick to it no matter what.

2) Developing trading plans and strategies for trades and sticking to them.

3) Refusing to overtrade. A trader should learn to walk away after a loss and live to trade another day.

4) Timing entries properly. For example, if a currency pair’s support is at 1.3010, and the market price is at 1.3030, check to see if the price had at any point in time come close to or actually touched 1.3010 in the recent past. If this is the case, do not give in to the temptation to place a Buy trade at 1.3030. The price is very likely to retrace to 1.3010 before it starts to reverse upwards. If you place a trade too early here and decide to cut your losses after going 20 pips in the red, you will lose out. The feeling is even worse when the price eventually reverses in your favored direction.

These are all great tips to help with your trading. What do you do to help become a more disciplined trader? Leave a comment below.

Our Rating: [yasr_overall_rating]